SOLUTIONS IN VISION - READER SURVEY - Part 2: Pinpointing the pain points of vision systems design

Part Two of our survey detailing the major concerns of designers and developers of vision systems.

James Carroll and Andrew Wilson

Three months ago, Vision Systems Design surveyed over 600 industry systems integrators to discover the problems our readers face in the design, integration, and maintenance of vision systems. We asked readers to use a 10-point pain scale to more easily communicate their most painful pain points in three different classes: product selection, operational limitations and other limiting factors (Figure 1).

After analyzing the data, our readers indicated that product obsolescence, the lack of standards and moving from existing vendors were their main concerns. These were then addressed by a number of industry experts, including manufacturers of machine vision cameras, software, cabling, lenses and optics, lighting (see "Pinpointing the pain points of systems design," Vision Systems Design, September 2015, pp. 14-19).

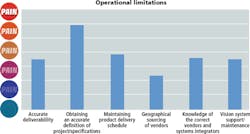

Operational limitations

Operational limitations such as obtaining an accurate definition of specifications, maintaining a product delivery schedule, and knowledge of the correct vendors and systems integrators to contact also featured prominently on our readers pain scale (Figure 2). Not surprisingly, obtaining an accurate product specification was of the greatest concern and indeed, one that is closely related to the lack of methods of standardizing such specifications.

"There is no excuse for a manufacturer not providing clear, accurate and readily available technical specifications for their products," says Paul Downey, Marketing Manager at Gardasoft Vision (Cambridge, England; www.gardasoft.com). "Aside from these, application-specific information is probably the most useful for developers (and often the most difficult for manufacturers to provide). This differentiates manufacturers because it is essential for both guidance and inspiration-so much so that the most successful vendors will likely be those who provide the best educational material and application advice about their products and technology."

"However," says Ritchie Logan, VP of Business Development at odos imaging (Edinburgh, Scotland; www.odos-imaging.com), "customers have such a wide-ranging set of requirements, it is largely impossible to publish a specification that fully encompasses every possible operational scenario. We therefore publish outline specifications only and invite customers to contact us directly with their individual requirements."

For camera vendors, adhering to specifications such as the EMVA 1288 specification allows cameras from different vendors to be more easily compared. "We perform camera tests according to the EMVA 1288 standard and provide customers with full reports as required," says Mike Troiano, Senior Director of Worldwide Sales at Allied Vision (Stadtroda, Germany; www.alliedvision.com). "However, the performance of a camera depends on many factors, some of which are application-specific. Thus, we always recommend customers to discuss their requirements and take advantage of our staff's expertise rather than choosing a camera by just comparing published specifications."

Eric Ramsden, Product Manager at Lumenera (Ottawa, ON, Canada; www.lumenera.com) agrees. While specifications such as read noise, full well capacity, dark current noise and dynamic range specifications are useful, the company also provides free evaluation units. "In this way," says Ramsden, "developers can compare our cameras to other competitive cameras and evaluate image quality and reliable frame delivery."

Lighting vendors also realize that specifications alone may not help developers choose the correct product for their application. "We encourage our customers not to rely simply on the published specifications but to contact us so that we can make recommendations after reviewing their application and testing some of their sample parts," says Mark Kolvites, Technical Sales Manager, Metaphase Technologies (Bristol, PA, USA; www.metaphase-tech.com). "We are often asked for our brightest and most uniform LED illuminator but it's really about which illumination system provides the contrast needed for the vision system at the required inspection speeds."

"Specifications provide nominal parameters for product performance," says Terry Arden, CEO of LMI Technologies (Delta, BC, Canada; www.lmi3d.com). "They allow you to zero in on an appropriate product model and weed out obvious mismatches. Final testing and validation is critical to ensure the application works. No serious buyer is going to purchase a product on published specifications alone."

Product delivery

While many of our readers expressed their concerns about vendors not maintaining predictable product delivery schedules, most manufacturers agreed that a close co-operation between vendors and developers could somewhat ameliorate this problem. "Accurate forecasting and planning from our customers is an important aspect of ensuring that our lead-times are minimized," says Michael Gibbons, Director of Sales and Marketing at Point Grey (Richmond, BC, Canada; www.ptgrey.com). René von Fintel, Head of Product Management at Basler (Ahrensburg, Germany; www.baslerweb.com) agrees. "We talk to our customers continuously to estimate if their timeline fits ours. This is possible as long as both parties share their information openly. Still, sometimes there can be a mismatch in which case a workaround or an interim solution must be found."

"Realistically, you have to interact with your customers to understand the generally acceptable time frame for delivery of your products," says Wallace Latimer, PLM Machine Vision at Coherent (Santa Clara, CA, USA; www.coherent.com). "Meeting commitments is a company culture that when executed produces superior service to customers. Suppliers must manage customer expectation against capacity and materials on a constant basis," he says.

For its part, Teledyne DALSA internally publishes lead times for standard products which are shared with all of its regional sales offices. "As we accept orders from customers, we verify delivery dates with our manufacturing units and communicate those dates back to customers. We track On Time Delivery (OTD) on a monthly basis and report those statistics as part of a quarterly review," says Philip Colet, Vice President of Sales at Teledyne DALSA (Waterloo, ON, Canada; www.teledynedalsa.com).

In some cases, however, customers may have requirements that cannot be met by a supplier by a desired date. Intercon 1 found this to be the case when working with a major OEM developing a new machine that uses sophisticated cables manufactured using unique materials and terminations.

"Due to the uniqueness of these assemblies," says Ron Folkeringa, Business Manager at Intercon 1 (merrifield, MN, USA; www.intercon-1.com) "we were not able to ship product at the rate the customer required. However, through daily meetings, we provided the customer with confidence that everything was being done to supply them product as quickly as possible. Even though it was not possible to achieve the original delivery schedule, the customer was pleased since there was open and direct communication."

Systems integration

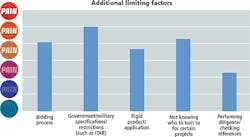

While our readers found the lack of complete product specifications and on-time product delivery schedules most frustrating, many said that they found it difficult to know which partner to choose as a systems integrator. This problem is compounded because each machine vision project demands different types of systems integration expertise. Indeed, not knowing who to turn to for developing specialized systems, ITAR restrictions and highly specialized project requirements also featured highly on our readers pain point scale (Figure 3).

"I have noticed that there seems to be more demand for system integrators willing to work on small projects," says Eric Ramsden, Product Manager at Lumenera. "Unfortunately, many system integrators would prefer to focus on larger programs that will provide higher return on investment (ROI)."

While the task of finding a systems integrator may be challenging, associations such as the AIA aim to make this task easier by providing a list of AIA-member system integrators and AIA Certified system integrators on their website. Many OEM suppliers also maintain their own lists of qualified developers that can be called upon when required. Cognex (Natick, MA, USA; www.cognex.com), for example, has a global network of systems integrators partners that are certified by the company. Similarly, companies such as Allied Vision, Datalogic (Bologna, Italy; www.datalogic.com) and MVTec Software (Munich, Germany; www.mvtec.com) maintain their own systems integration partner programs.

"Many of our distributors are systems integrators and many of our systems integrators are our customers," says Mike Troiano, Senior Director of Worldwide Sales at Allied Vision. "While no two applications are the same, we probably know a company that can solve your problem because they have experience in similar applications."

ITAR restrictions

Those readers faced with developing imaging projects for the military are also subject to International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR). These regulations, published by the US Government, control the export and import of defense-related products.

"ITAR and Commerce Department regulations are the same for any US company or person doing business in the US whether or not the business is in the US or abroad," says Coherent's Latimer. "Generally speaking, products built and sold for machine vision systems are COTS items and would only be considered controlled if they were being shipped to restricted locations. This is a segment of business that needs to be managed by trained resources and companies need to make conscious decisions if they want to participate in this segment of the market."

Intercon 1 has many customers with ITAR and/or AS 9100 requirements. "We are fortunate to be part of a larger company-Nortech Systems - and machine vision projects that have ITAR or AS 9100 requirements are managed through Nortech Systems," says Intercon 1's Folkeringa.

A key in determining whether an export license is needed from the Department of Commerce is finding out if the item you intend to export has a specific Export Control Classification Number (ECCN). ECCNs are five character alpha-numeric designations used on the Commerce Control List (CCL) to identify dual-use items for export control purposes.

Allied Vision has some products that fall under dual-use restrictions. "The best way to address this with a potential customer is to determine where they deploy the technology and to supply them with the relevant ECCN. This is usually enough for the customer to determine if the project is feasible," says Allied Vision's Troiano.

"Alas, everything we touch for the most part is subject to ITAR," says Chris Alicandro, Vice President of Sales and Business Development at Sofradir EC (Fairfield, NJ, USA; www.sofradir-ec.com). "We have an export compliance officer who manages the processes but we all participate in self-policing. We take this quite seriously. This manifests itself through both customer education and oversight of our sales channels," he says.

Next month continues our Solutions in Vision series with a survey, developed in conjunction with FRAMOS (Taufkirchen, Germany; www.framos.com), that will examine the most popular industrial and scientific sensors and cameras on the market. This issue will also include our annual Industrial Camera Buyer's Guide listing of over 500 camera manufacturers, their products and camera specifications. Follow "Solutions in Vision" through December here.

Companies mentioned

Allied Vision

Stadtroda, Germany

www.alliedvision.com

Basler

Ahrensburg, Germany

www.baslerweb.com

Cognex

Natick, MA, USA

www.cognex.com

Coherent

Santa Clara, CA, USA

www.coherent.com

Datalogic

Bologna, Italy

www.datalogic.com

Framos

Taufkirchen, Germany

www.framos.com

Gardasoft Vision

Swavesey, Cambridge, England

www.gardasoft.com

Intercon 1

Merrifield, MN

www.intercon-1.com

LMI Technologies

Delta, BC, Canada

www.lmi3d.com

Lumenera

Ottawa, ON, Canada

www.lumenera.com

Metaphase Technologies

Bristol, PA, USA

www.metaphase-tech.com

MVTec Software

Munich, Germany

www.mvtec.com

odos imaging

Edinburgh, Scotland

www.odos-imaging.com

Point Grey

Richmond, BC, Canada

www.ptgrey.com

Sofradir EC

Fairfield, NJ, USA

www.sofradir.com

Teledyne DALSA

Waterloo, ON, Canada

www.teledynedalsa.com