Industrial camera technologies, interfaces and applications

Manufacturers and developers review the status quo of the industrial camera market and how will it develop in future.

Ute Häussler

In collaboration with Vision Systems Design and Inspect magazines, FRAMOS (Taufkirchen, Germany; www.framos.com) has conducted a market survey of trends, interfaces and future developments in camera technology. The study is based on the opinions of 79 users and 20 manufacturers, 47% who were from North and South America, 38% from Europe and 15% from Asia. In the study, Europe ranked first in terms of both purchasing and production at 57% among users and manufacturers; 28% of the remaining production output came from manufacturers in North and South America and 13% from Asia.

While camera vendors cited that production automation and measurement applications comprised 24% and 22% of sales respectively, logistics and quality assurance applications ranked equally at 13%. Similar results were reflected by camera users who said that 60% of the cameras they purchased are deployed in automation applications, 22% in quality assurance applications and 14% in measurement applications. Of the camera vendors surveyed, 39% sell directly to system manufacturers, 32% to integrators and 24% to end-users.

As in past years, both camera manufacturers and systems developers see a continued growth in the image processing and machine vision industry with 90% of users intending to introduce or to replace existing systems within the next two years.

Camera pricing

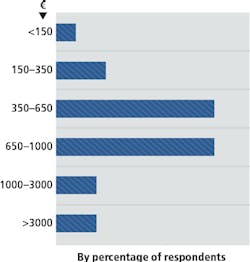

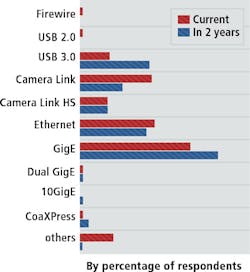

Whereas in 2014, camera manufacturers produced 70% of their cameras at prices between €150-650, only 44% were produced at these prices this year. This year's survey found that 33% of all cameras are produced at prices between €650-1,000, 9% are priced at €1000+ and 9% at €3000+ (Figure 1). This shows that customised cameras commanding higher prices are once again in demand.

Users now indicate that they want to buy at least 23% of their cameras at prices of up to €150. With 44% of purchasing volume between €150-650 (15% less than in 2014), users are making the same assessment as manufacturers. Purchasing volume has changed only marginally for cameras priced over €650, €1000 and €3000+.

While the increase in purchasing of low-cost cameras has been fueled mainly by the price declines in €150-350 range, users requiring higher quality, and those with specific application requirements, are more willing to invest accordingly and manufacturers are following this trend. Thus, production of customized cameras for specific applications is a strong selling point, and a market advantage, for smaller camera manufacturers.

CMOS vs CCD

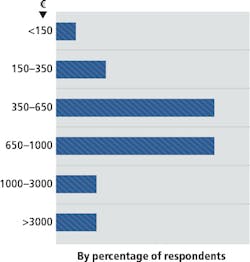

In the light of Sony's discontinuation of CCD imagers, users see the greatest growth for companies such as ON Semiconductor, which currently holds a 24% market share. Among manufacturers, CMOSIS and Sharp are viewed as alternative sensor suppliers (Figure 2). Both users and manufacturers foresee declines in Sony's market share, to 39% (among manufacturers) and 25% (among users). Both groups plan to transition to CMOS sensors, which in two years are projected to hold a market share of 80%.

While 10% of manufacturers and 14% of users will use non-Sony CCD sensors, 10% and 28%, respectively, will switch to CMOS with some using CCD technology for more specialized applications. However, it remains to be seen how CMOS technology can further reduce the market share currently held by CCD-based cameras, the impact Sony's strategy change will have and which brands will ultimately profit from it.

In the next two years, the most significant declines will be seen by sales of cameras with sensors of under 1 MPixel. All other megapixel classes are set for growth, with manufacturers seeing the most growth in resolutions of 5 MPixel and higher (+8%), while users favor (for now) the range between 1-5 MPixel (+9%). While manufacturers predict the market share for cameras with frame rates of 60 fps and higher to increase by 19%, users predict a similar growth of +15% of cameras that sport 60-100 fps frame rates.

Standard interfaces

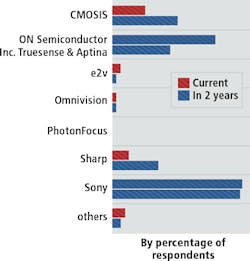

Besides GigE Vision, USB 3.0 is the fastest-growing camera-to-computer interface and in two years is expected to become the second most popular standard after GigE with manufacturers and users predicting growth rates of 10% and 19% respectively. Among systems integrators, the GigE standard proved the most popular followed by Camera Link and USB 3 (Figure 3). Both groups project that CoaxPress will grow by 3%, while all other interfaces will decline in market share.

The GigE Vision standard which has implemented by 55% of camera manufacturers and 21% of users is predicted to remain the most popular standard over the next two years. As 88% of manufacturers and 73% of users rate bandwidths over 5GBytes/s to be important, just under 70% of each group believe that the USB 3.1 or 10 GigE standards will be most popular.

Ute Häussler, Marketing Communications Manager, FRAMOS (Taufkirchen, Germany; www.framos.com)