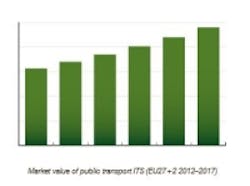

European public transport intelligent transportation system market expected to reach $1.8B by 2017

The market value for intelligent transportation systems (ITS) deployed in public transportation operations in Europe is expected to grow from $1.2 billion (€ 0.94 billion) in 2012 to $1.8 billion (€ 1.44 billion) in 2017 at a compound annual growth rate (CARG) of 9%.

ITS systems are used for a multitude of purposes, including measuring traffic flow, identifying vehicles at tolls, and more. In order for these systems to work, they must include embedded computers and server farms capable of collecting thousands of images per second and computers capable of analyzing those images for vehicle recognition or traffic flow monitoring.

Analyst firm Berg Insight, the company that released the research report, suggest that the market for ITS in public transport is in a growth phase which will continue throughout the forecasted period. Rickard Andersson, senior analyst for Berg Insight, said in a press release that developments on both national and European Union levels will spur the growth.

"Public investments in ITS are set to grow in many regions at the same time as international initiatives such as the EBSF EU project and UITP’s sought-after doubling of the public transport ridership are anticipated to boost industry activity," he said.

In addition, the global trend of smart city initiatives will also be a major driver as ITS systems in general and public systems are key elements of supporting sustainable smart mobility, suggests Andersson.

Companies mentioned in the report as industry leaders in Europe include Trapeze Group, INIT and IVU. In addition, local companies with considerable market shares on regional markets in Europe include Ineo Systrans in France and Vix in the UK. Additional companies mentioned in the report include Spanish groups GMV, Indra and Grupo Etra, Swarco’s subsidiary Swarco Mizar in Italy, the Norwegian provider FARA, the Belgium-based company Prodata Mobility Systems, Volvo Buses, and Consat Telematics.

View more information on the report.

Also check out:

JAI VISCAM 1000 traffic imaging system produces readable plate images across multiple lanes

(Slideshow) 10 innovative current and future robotic applications

Researchers create remote traffic pollution detection camera prototype

Share your vision-related news by contacting James Carroll, Senior Web Editor, Vision Systems Design

To receive news like this in your inbox, click here.

Join our LinkedIn group | Like us on Facebook | Follow us on Twitter | Check us out on Google +

About the Author

James Carroll

Former VSD Editor James Carroll joined the team 2013. Carroll covered machine vision and imaging from numerous angles, including application stories, industry news, market updates, and new products. In addition to writing and editing articles, Carroll managed the Innovators Awards program and webcasts.