Market for cathode-ray tubes

Market for cathode-ray tubes

By Brian Fedrow

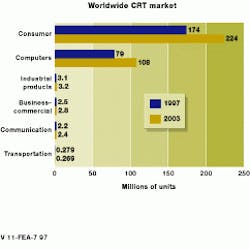

he total worldwide market for cathode-ray tubes (CRTs) is projected to climb past $34.4 billion in sales of 341 million units by 2003, compared to $26.2 billion for 261.5 million units in 1997. The impetus for this strong growth comes primarily from sales of color televisions and desktop computer monitors. In these two large markets, flat-panel-display technologies are expected to exhibit growing, but still limited, penetration through 2003.

The largest market segment--consumer products at

55% share--is expected to grow from $14.3 billion for 174 million units shipped in 1997 to $20.8 billion and 224 million units shipped in 2003 (see figure). This market consists of color-TV screens, pocket TVs, portable VCRs, monochrome TV screens, projection TVs, and camcorder viewfinders.

As the second largest market segment, computer products are anticipated to rise from $11.1 billion for 79 million units shipped in 1997 to $12.8 billion and 108 million units shipped in 2003. This market includes data terminals, desktop PC monitors, and workstations.

In a distant third place, the industrial-products segment is predicted to remain essentially level over the forecast period, with 3.1 million units shipped in 1997 and 3.2 million units shipped by 2003. This market, which is expected to reach $320 million in 2003, covers test equipment, analytical equipment, medical instruments, and process-control subsystems.

During the forecast period, the Far East region, including Taiwan, Korea, China, Singapore, and Thailand, is estimated to become the largest consumer of CRTs, both in units and in sales. It is expected to expand from a $13.3 billion market, with 155 million units purchased in 1997, to $16.6 billion and 200 million units purchased in 2003.

Leading sales are attributed to the Far East region`s high-volume production of CRT computer monitors and color televisions. Some of the display consumption in the Far East is based on Japanese-owned facilities. What`s more, some of the CRT production is expected to shift to the second-largest consumer--the North American region--during the forecast period. The North American region is anticipated to consume more than 58 million units valued at $8.1 billion by 2003.

Technology trends

The CRT performance/price ratio represents the strength of CRT technology, and it will likely remain the weakest attribute for the challenging flat-panel technologies. However, unit prices are expected to erode steadily because the perceived value of flat-panel profiles should increase slowly as manufacturers promote the worth of "leading-edge" technologies.

In the CRT television market, the 25-in. color set of the 1980s is being replaced by the 27- to 40-in. sets of the 1990s. In fact, the worldwide market for color-television CRTs larger than 28 inches is calculated to grow more than 20% through 2003.

With the coming of digital televisions and eventually digital high-definition televisions (HDTVs), the 16:9 aspect ratio screen is expected to replace the conventional 4:3 aspect ratio for most televisions by the early 2000s. However, in Japan, HDTV sales have flattened out during 1996. Moreover, in the United States and Europe, such sales show no signs yet of strong emergence. This market segment is still in question.

In the personal-computer CRT monitor market, 15- to 17-in. CRT monitors are driving the migration to Microsoft Windows software and a 1024 ¥ 768-pixel format. Workstation displays are envisioned to continue using 20-in. monitors at a 1280 ¥ 1034-pixel format, but some migration to 21-in. screens is expected. The 17-in. screen size has also become popular for workstations during the past two years, accounting for 33% of US workstation monitor sales in 1995.

After several years of development, two new CRT sizes entered the market during 1997: the 19-in. flat-square data-display tube from Hitachi and other vendors and the 24-in.-wide screen Trinitron tube from Sony. The 19-in. flat tubes are expected to pull users away from the 17-, 20-, and 21-in. CRT markets. Already being installed in desktop and workstation markets, the 24-in. tube provides a 1920 ¥ 1200-pixel format, a horizontal scanning frequency of 30 to 96 kHz, and an aperture-grille pitch of 0.25 mm.

Another innovation in data-display tube technology is the short-neck CRT from Matsushita. Its new 17-in. unit, called Pure Flat Tube, comes with a 100 wide deflection angle. A 19-in. version is also under development.

The desktop PC monitor market in North America is expected to more than quadruple from 1997 to 2003, with this year`s CRT shipments totaling 4.4 million units and rising to 19.1 million units. The color desktop-computer monitor market is predicted to grow from 70.7 million units shipped in 1997 to 101.8 million units shipped in 2003 at a 6% compound annual growth rate. The color workstation-monitor market is expected to rise at a 7% growth rate to nearly 2 million units shipped by 2003.

During 1997, graphic flat panels entered the marketplace, but at much higher prices than for CRT types. Also in 1997, this $37.9 billion market is being shared by CRTs at a 69.4% share and flat panels at a 30.6% share. These numbers are expected to reverse markedly in 2003, with a $59.9 billion market shared by flat panels at a 42.6% share and CRTs at a 57.4% share.

Brian Fedrow is vice president, information development, Stanford Resources Inc., San Jose, CA 95120; e-mail: [email protected].

In worldwide CRT monitor sales, the consumer-market segment, consisting of color and monochrome television screens, pocket televisions, portable video-cassette recorders, projection televisions, and camcorder viewfinders, is expected to ship more than 174 million units in 1997, climbing to 224 million units shipped in 2003. Trailing far behind are the computer market (79 million units shipped in 1997 and moving to 108 million units in 2003) and the industrial-products market (3.1 million units shipped in 1997 and barely rising to 3.2 million units shipped in 2003).