When Will Growth Return to the Machine Vision Market?

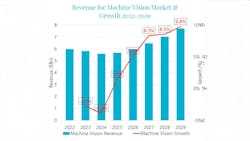

The global machine vision market will grow by 1.5% in 2025 and 5.2% in 2026, predicts Interact Analysis (Northampton, UK) in a new report.

Interact Analysis forecasts a rosier growth outlook for the remainder of the decade: 8.3% in 2027, 8.5% in 2028, and 9.8% in 2029. By 2029, the global machine vision market should be worth $7.7 billion—overtaking the $6 billion in value the industry logged in 2022 when restocking post-Covid led to robust sales.

The market research company released its report at Automate, which was held May 12-15 in Detroit, Michigan. The annual trade show is organized by the Association for Advancing Automation, or A3 (Ann Arbor, MI, USA).

The impact of growth in the machine vision market during the remainder of the decade will drive up the average cost per unit from $310 in 2023 to $325 in 2029, Interact Analysis reports. Jonathan Sparkes, research analyst at Interact Analysis, notes that the cost per unit includes a broad range of products, everything from a $10,000 camera to a $20 cable.

Related: Automate 2025 Machine Vision Product Preview

The forecast for growth follows several years of declining revenues. Revenue fell 2.8% from $6 billion in 2022 to $5.8 billion in 2023 and 3.9% from $5.8 billion in 2024 to $5.6 billion in 2024, according to the market research company.

Despite the uncertainty created by the Trump Administration’s tariff policies, the research company expects its 2025 forecast for the machine vision market to come to fruition, according to Sparkes. “As of today, a lot of companies are saying that they are not seeing a lot of impact,” he says.

Related: A3 Predicts Uptick in Automation and Machine Vision Sales in 2025

The impact of tariffs on longer-term growth is yet to be determined. But he notes that machine vision manufacturers may absorb the cost of tariffs into their prices. For example, if a camera company offered a 20% bulk discount to its customers in the past, it now may offer only offer a 10% discount.

Factors Driving Revenue Growth

However, there are strong drivers of growth in the machine vision market, which may help shield the industry somewhat from the impact of the tariff policies.

“We see growth based on the technology—the complexity of vision being used. Where once upon a time it was a 2D camera performing one task, people are paying more for a 3D camera that is able to perform multiple tasks or automate further workflows. Application-wise there is a lot going on with using vision to automate further tasks, whether that is in manufacturing or non-manufacturing industries like in logistics,” he says.

Related: Software Basics in 3D Imaging Components and Applications

Bin picking and palletizing are examples of tasks the logistics industry is automating using robotics and machine vision, specifically 3D cameras and AI-enabled software.

3D Machine Vision

The four types of 3D imaging that Interact Analysis studies are the following:

- Stereo vision in which a scene is imaged from two viewpoints.

- Time-of-flight (ToF) in which the sensor measures the time it takes for light to reach an object and then reflect back to the sensor.

- Triangulation determines an object's location in 3D space with a sensor, or detector, that takes a series of images of a line projected on an object by a laser.

- Structured light is similar to triangulation but extends to an entire field of view. In this method, scanners take a sequence of images of patterns of light projected on an object.

Interact Analysis forecasts 57% growth in revenues for 3D cameras between 2024 and 2029, driven by strong sales in stereo and ToF cameras, which Sparkes says tend to be less expensive than cameras based on triangulation or structured light.

The average price per unit for 3D cameras will decrease from $4,900 in 2024 to $4,500 in 2029, reflecting the increase in sale volume, particularly of the less expensive 3D technologies.

Neural Networks

Another strong driver of growth is the use of deep learning and other neural networks in vision applications. “It is in the real world and people are seeing the benefits of it,” Sparkes says. “It is opening the door for new customers that have never automated before. It is giving them the opportunity to grow and see where they can automate and how to automate.”

Related: How to Deploy Deep Learning Neural Networks in Machine Vision

The influence of AI is clearly visible in the firm’s forecast for software sales: 52% growth from 2024 to 2029.

Automation in manufacturing is a third strong driver for machine vision growth, he says. “If you are going to automate something that was manual before, vision often plays a part of that solution,” he explains. He points out the example of automated systems to inspect batteries for electric vehicles.

The company’s database and research comprise information on more than 200 machine vision manufacturers in 15 product categories including smart cameras, smart sensors, configurable vision systems, line scan cameras, area scan cameras, four 3D camera types, frame grabbers, lighting, lenses, software, sensors, and accessories.

Market Share of Prominent Machine Vision Manufacturers

In addition to global growth forecasts, Interact Analysis also reported on the global market share of the industry’s largest players in 2024. At 14.2%, Keyence (Osaka, Japan) held the largest market share, followed by Cognex (Natick, MA, USA) at 11.4%. The market share of other prominent companies in 2024 was 6.8% for TKH Vision (Konstanz, Germany), 6.5% for Teledyne Solutions (Thousand Oaks, CA, USA), 6.2% for Hikrobot (Hangzhou, China), 3.4% for Basler (Ahrensburg, Germany), 2.3% for Omron (Kyoto, Japan), 2.1% for OPT Machine Vision Tech (Dongguan City, China), 1.8% for Baumer (Frauenfeld, Switzerland), and 1.4% for SICK (Waldkirch, Germany).

Chinese machine vision companies are putting pressure on prices, Sparkes adds. Many companies from other countries are responding by emphasizing service throughout the sales and installation process. For example, camera and lens companies help customers integrate their products into the complete machine vision system, making sure the product “works as it should and is optimized,” he says.

About the Author

Linda Wilson

Editor in Chief

Linda Wilson joined the team at Vision Systems Design in 2022. She has more than 25 years of experience in B2B publishing and has written for numerous publications, including Modern Healthcare, InformationWeek, Computerworld, Health Data Management, and many others. Before joining VSD, she was the senior editor at Medical Laboratory Observer, a sister publication to VSD.