Key Economic Insights from the 2026 A3 Business Forum

The 2026 A3 Business Forum, held in Orlando, Fla., Jan. 19-21, revealed an optimistic yet measured outlook for machine vision, robotics, and automation. The economic data presented by the Association for Advancing Automation, or A3, (Ann Arbor, MI, USA) and ITR Economics (Manchester, NH, USA) indicates expanding opportunities in vision software, AI applications, and sector diversification prudent to machine vision professionals.

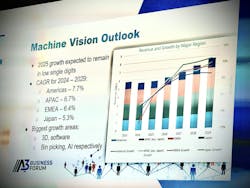

Machine Vision Market Poised for Expansion

Alex Shikany, executive vice president at A3, highlighted that while full 2025 revenue data from the largest public vision companies in the Americas are not yet available, preliminary analysis from Interact Analysis projects machine vision markets to grow at a compound annual growth rate (CAGR) of approximately 7.7% through 2029. “The biggest growth areas are 3D vision software, bin picking, and AI applications,” he said.

While automotive remains the largest sector for vision integration—owing to the extensive use of cameras in vehicles—logistics and warehousing represent the fastest growing market segment for machine vision, with anticipated annual growth near 14.2%. Emerging application fields beyond traditional manufacturing, including sports and entertainment (forecasted to grow 8.8%), traffic systems (9.4%), and agriculture (5.2%), also offer notable expansion paths.

Machine vision inspection holds the largest application share, expected to reach $3.39 billion globally by 2029 with a steady 4% CAGR. Autonomous driving and sensing technologies within vision are also advancing rapidly, he said.

Shikany noted the role of AI in machine vision and automation. He said, “AI is there; we have to pay attention to it…because frankly, it’s getting better at everything that we (humans) could possibly do,” covering capabilities such as image classification, visual reasoning, language understanding, and complex multitasking. This surge in AI-driven capabilities is set to reshape product development and operational efficiency across the industry.

Robots, Automation Growth Supports Vision System Demand

Data presented revealed a 6.6% increase in North American robot orders in 2025, totaling about 37,000 units. A significant share, approximately 19%, were collaborative robots with the majority deployed outside the automotive sector. General industries are increasingly adopting robots—and by extension integrating vision and sensing systems at accelerated rates.

Material handling, including palletizing and pick-and-place operations, grew by 24% in 2025 and represents a substantial driver for vision system integration and logistics and distribution centers.

In one highlight, Shikany pointed to digital twin and physical AI applications in warehouse automation, such as the partnership between Nvidia, Accenture, and Kion. These solutions allow robotic fleets to plan and execute tasks within simulated environments, optimizing throughput and efficiency before deployment—a promising development for vision-enabled automation.

Economic and Industry Context from ITR Economics

In Brian Beaulieu’s presentation, the consulting principal and chief economist at ITR Economics pointed to a broader economic picture influencing the machine vision market. He forecasted 12.6% growth in industrial production for 2026, slowing to 7.9% in 2027 before rebounding the following year. “There's a lot to be had out there in the way of growth,” Beaulieu said, highlighting the forecasted 25% rise in North American robot shipments through 2028.

Beaulieu cautioned about challenges, particularly inflationary pressures and rising labor costs—wages are expected to increase roughly 20% by 2029, he said—requiring companies to focus on margin management rather than top-line revenue alone. Energy costs, too, are rising, though emerging technologies like small modular reactors (SMRs) could offer future relief.

He provided perspective on AI as an incremental productivity enhancer rather than a rapid job displacer—projecting adoption acceleration aligned with generational shifts. Labor market tightness, especially among millennials with a strong 84.5% participation rate, adds to cost and operational pressures.

Geopolitical factors, including tariff uncertainties and U.S.- China tensions, with possible conflict over Taiwan by 2027, remain critical considerations for supply chains and semiconductor manufacturing—both necessary for high-performance vision systems.

Looking ahead, Beaulieu issued a caution about demographic headwinds leading to a potential economic downturn in the 2030s, advising companies to maintain liquidity and prepare strategically.

Takeaways for Machine Vision Professionals

Growth opportunities: Machine vision software, AI enabled applications, and logistics-related automation are leading sectors for expansion through 2029.

Technological integration: Digital twin simulations and physical AI create new avenues for vision-integrated robotics and system deployment.

Cost and workforce challenges: Inflation, wage growth, and labor shortages require careful financial and operational planning.

Strategic diversification: Broadening market focus beyond automotive to logistics, agriculture, and emerging verticals is vital.

Advocacy and industry support: Strengthened national robotics strategies and ongoing advocacy efforts support technology development and adoption.

A3 members can access more detailed market intelligence, including data reports, and connect with experts to guide their decisions in the evolving automation and regional landscape.

About the Author

Sharon Spielman

Editor in Chief / Head of Content

Sharon Spielman joined Vision Systems Design in January 2026. She has more than three decades of experience as a writer and editor for a range of B2B brands, most recently as technical editor for VSD's sister brand Machine Design, covering industrial automation, mechanical design and manufacturing, medical device design, aerospace and defense, CAD/CAM, additive manufacturing, and more.