Report: Self-driving car market represents $87 billion by 2030

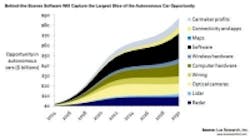

A new report from Lux Research suggests that car manufacturers and technology developers building self-driving cars will create an $87 billion opportunity in 2030, with software representing a key component of the potential market growth.

The report classifies self-driving cars into Level 2, which includes features like adaptive cruise control, lane departure warning, and collision avoidance braking; as well as the more advanced, semi-autonomous level 3, which includes cars that utilize high-resolution maps but do not obtain full autonomous navigation. Level 4 cars, which represent cars that can navigate completely on their own, are also classified, but the report suggests that these vehicles are not likely to appear until 2030.

Automobiles with Level 2 features are expected to account for 92% of autonomous vehicles by 2030, with Level 3 automobiles representing the remaining 8%. A number of different companies across various industries are expected to contribute to the development of self-driving cars, according to Cosmin Laslau, Lux Research Analyst and lead author of the report titled, "Set Autopilot for Profits: Capitalizing on the $87 Billion Self-driving Car Opportunity."

"Today the autonomous vehicle value chain is already starting to take root, and it involves many players new to the industry," he said in the press release. "Sensor hardware specialists like Velodyne Lidar are developing products with unprecedented resolution, software and big-data powerhouses like IBM and Google are striking up partnerships, and even mapping and connectivity experts like Nokia and Cisco are throwing their hats into the ring."

Google recently presented a new prototype of its driverless car technology, which had no steering wheel, gas pedal, or brakes. Later in the summer, Google plans to begin testing of its early versions of the car which have manual controls. If the tests are successful, the company plans to run a small pilot program in California in the coming years.

Lux Research also indicates in the report that the opportunity in autonomous vehicles will initially be led by the United States and Europe, but China will grow to claim a 35% share of the 120 million cards sold in 2030, accounting for revenues of $24 billion, against $21 billion for the U.S. and $20 billion for Europe.

It also found that software will be the competitive differentiator, as the opportunity for the development of software in autonomous cars will grow from $0.5 billion today to $10 billion in 2020 and $25 billion in 2030, offering software companies such as Google and IBM a significant opportunity. The report also suggested that only about 250,000 Level 4 cars will be sold in 2030, as fully autonomous vehicle technology is still a work in progress.

View the press release.

Also check out:

Global expansion aids record-setting 2013 for German machine vision market

(Slideshow) Six unique ways 3D imaging helped solve problems

GigE camera provides vision for self-steering car competition winner

Share your vision-related news by contacting James Carroll, Senior Web Editor, Vision Systems Design

To receive news like this in your inbox, click here.

Join our LinkedIn group | Like us on Facebook | Follow us on Twitter | Check us out on Google +

About the Author

James Carroll

Former VSD Editor James Carroll joined the team 2013. Carroll covered machine vision and imaging from numerous angles, including application stories, industry news, market updates, and new products. In addition to writing and editing articles, Carroll managed the Innovators Awards program and webcasts.