Quality drives European vision-market growth

By S. Gomathinayagam

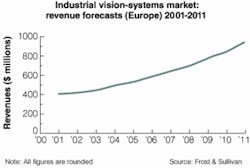

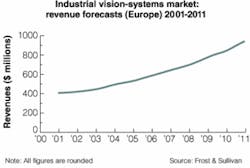

Increased sales, emergence of new competitors, and sustained marketing and promotional activities by vendors are all clear indications that the European industrial vision-systems market is growing. Based on a recent market study by Frost & Sullivan, we estimate that the market witnessed moderate growth in revenues over 2001-2004, reaching $500 million in 2004. The compound annual growth rate (CAGR) was 6.8% during this period.

Stringent quality and quality-control requirements, increasing throughput on the production lines, and the need to offer defect-free products are the chief drivers fueling the demand for vision systems. Technology advancements have been making vision systems that meet these requirements more capable, viable, and easy to use (see Fig. 1). These developments are expected to increase the demand for vision systems over the next five or six years. The industrial vision-systems market in Europe is expected to reach $948.4 million by 2011, with a CAGR of 9.6%.

BY PRODUCT LINE

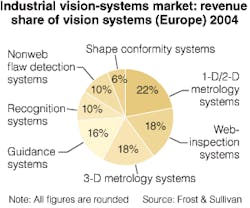

Dimensional metrology systems, guidance systems, and web-inspection systems have cornered the largest market share by value in Europe in 2004. One-, two-, and three-dimensional metrology systems together represented 40% of the 2004 market. Guidance systems and web-inspection systems represented 16% and 18%, respectively, in 2004.

Three-dimensional metrology systems are expected to increasingly replace 2-D metrology systems as they become more user-friendly. Demand for nonweb flaw-detection systems for surface inspection of discreet parts in the automobile, glass work, woodwork, and ceramic industries is expected to sustain revenue growth over the next five or six years.

Moderate demand is expected for guidance systems from the automotive sector, and semiconductor industries should see the revenue share more or less stable over the period 2005-2011. Recognition systems and shape-conformity systems are expected to grow slower than the industry and the revenue share is expected to dip (see Fig. 2).

BY GEOGRAPHIC REGION

Germany is the largest of the regional markets for industrial vision systems in Europe. It represented 35.9% of the total market in 2004. The UK and the French markets represent the next biggest market for the industrial vision systems. End users such as the electronics and semiconductor, automotive, and mechanical-engineering segments fueled the demand for vision systems in these regions. Strong growth projected from these segments is expected to sustain the revenue growth of these markets.

The Scandinavian market is expected to be more or less stable on the revenue share over the forecast period 2005-2011, as vision systems find greater acceptance among the woodwork, pulp and paper, and food-and-beverage industries.

The relative maturity of the Italian automotive and mechanical industries is expected to contribute to the decline in the revenue share of the region over the next five or six years. Other smaller regions such as Iberia and Benelux are also expected to witness a drop in revenue share as the end-user demand is not expected to sustain revenue growth.

The Eastern European market represents the region of greatest potential growth. Low cost of manufacturing and proximity to the European region make it an attractive alternative to other low-cost destinations, such as the Far East. However, unless fresh investments into new projects are sustained, the revenue share of the region is expected to decline (see Fig. 3).

COMPETITIVE LANDSCAPE

More than 150 companies operate in the European industrial vision-systems market. They provide a range of vision systems and components and offer system-integration and consultancy services. Most of the companies are small- and medium-sized business startups catering to regional markets. The Europeanwide market is dominated by large multinationals that are based outside of Europe or that have strength through subsidiaries and distributors.

The European market is highly competitive. Participants offer similar product ranges with similar performance at a similar price. Under such circumstances, product innovation and time to market become the key differentials. Market participants strive to bring out innovative products to satisfy customer needs and differentiate themselves. Investments in research and new-product development programs are expected to rise as time to market becomes even more critical.

The industrial vision-systems market in Europe is expected to show continued growth over the forecast period, 2005-2011. Increasing throughput on one hand and stringent quality requirements on the other are expected to drive more end users to adopt machine-vision systems for ensuring that defect-free products reach their customers.

The key to success in this vision-systems market is to have customer focus. Market participants who can foresee customer requirements and develop innovative solutions to satisfy the customers and who focus on ensuring a lasting relation with the customer can expect to be more successful.

S. GOMATHINAYAGAM is a research analyst in the Sensors Group at Frost & Sullivan, London, UK; www.frost.com.