By Tom Wang Wei

The People’s Republic of China is a natural target of growth and expansion for automation and machine-vision companies abroad. Although economic reforms have been ongoing over the last 20 years, foreign investors still possess little understanding of Chinese market characteristics. This has been one of the biggest obstacles when trying to penetrate the Chinese market.

Generally, machine-vision suppliers can be classified into two categories: machine-vision component suppliers and machine-vision vertical solution providers. International machine-vision companies seeking a stake in the Chinese market will need first to identify the target market segments and then select suitable partners. The success of the partners will be the key to success in the Chinese machine-vision market.

The machine-vision suppliers are companies that manufacture and supply discreet machine-vision components such as domestic or imported cameras, optics, illumination devices, smart cameras, and image-processing hardware and software. The vertical solution providers are companies that offer turnkey machine-vision system solutions to specific industries. This category includes 3-D IC inspection systems and automated-optical-inspection (AOI) systems.

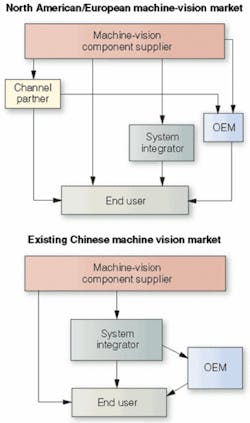

For machine-vision vertical solution providers, the market segment is well defined by the industry type that they serve, while the main market focus for machine-vision component suppliers is general-purpose machine vision. Therefore, selecting a suitable business model and market segment becomes challenging in the relatively new Chinese machine-vision market, especially given the significant differences between North American/European and Chinese machine-vision markets (see Fig. 1).

Component supplies are dominated by companies from North America and Europe. There are only a few local Chinese suppliers that focus on low-cost hardware, with very limited product offerings. Almost 80% of the local Chinese machine-vision companies are machine-vision component distributors. A majority of their revenue comes from trading and distribution.

OEMs are rare in China. Most of them serve the PCB and SMT markets. Typically, they use many AOI systems. Potentially, China has a very large end-user base for such machine-vision applications.

STRATEGIC APPROACH

For international suppliers to penetrate the Chinese machine-vision market, channel partners and system integrators will play an important strategic role in the business model. These companies typically fall within one of three types: imaging, automation, or system integrators (see Fig. 2).

The pioneers of image processing in China came from the military, government-research communities, and academic institutes. Most of the early local Chinese imaging companies are spinoffs from one of these three organizations. Most of the R&D has been focused on image processing and low-cost imaging hardware design. At the same time, these companies distribute imaging products from overseas suppliers. Most of their customers are from the research community and organizations that they previously served.

Theoretically, these companies already possess the imaging hardware and software knowledge to handle and market machine-vision products. Historically, these companies are popular candidates for local Chinese partners. However, these imaging companies lack automation and manufacturing experience. The common weakness in these companies is that they adopt a “research” approach by focusing on component-level requirements instead of application-level requirements.

The Chinese automation market has been growing rapidly over the last 15 years. The growth has inspired the rise of many local Chinese automation companies. These companies deal directly with end users and OEMs. They distribute PLCs, sensors, servomotors, and drives to end users and OEMs. Geographically, these companies are also close to their customers. Their direct relationships with end users and OEMs present a window of opportunities to potential machine-vision requirements. In addition, they understand the manufacturing environment and possess extensive integration and implementation experience.

For international machine-vision companies, the drawback of working with these local Chinese automation companies is that machine vision will always be only part of their product portfolio. Unlike imaging or system-integrator companies, they also lack experience with machine-vision products.

Machine-vision system-integrator companies are usually startups founded by machine-vision engineers. They are either returning Chinese who had worked for an overseas machine-vision company or local Chinese engineers who have been through several machine-vision project cycles. These companies have their own niche markets and customer base.

From a technical perspective, they possess extensive machine-vision project experience and machine-vision product knowledge. And they understand the full project-development cycle from presales evaluation to postsales support.

The advantage of working with them is that their main focus is machine-vision products. Apart from component selling, they can sell solutions, as well. However, these companies are a rare breed in China. The biggest disadvantage in working with these companies is that they are generally small startups that typically focus on one or two vertical markets.

Imaging companies are sutiable channel partners for machine-vision component suppliers providing cameras, lighting, and machine-vision hardware and software. They provide direct entry points to the military, research communities, and academic institutes.

As for automation companies, they make good channel partners for machine-vision components such as camera, lighting, and optics. Their existing pool of automation and OEM customers provides opportunities to the manufacturing world. Because of the lack of machine-vision knowledge, they are not equipped to sell machine hardware and software.

Unlike the imaging and automation companies, system integrators are ideal partners for providing turnkey machine-vision solutions. The difference is product sales versus project sales. With limited finances, smart cameras and solutions should be the main product focus. This also coincides with the preference for smart cameras in the China market. At the same time, the strategy should emphasize selling solutions. Most of the time, customers need a solution rather than a product. The aim is to add value and differentiate oneself from the competition.

TOM YANG WEI is a senior machine-vision application engineer based in Shanghai, China; [email protected] or his blog (in Chinese): www.blogcn.com/u/33/63/mvtom/index.html.